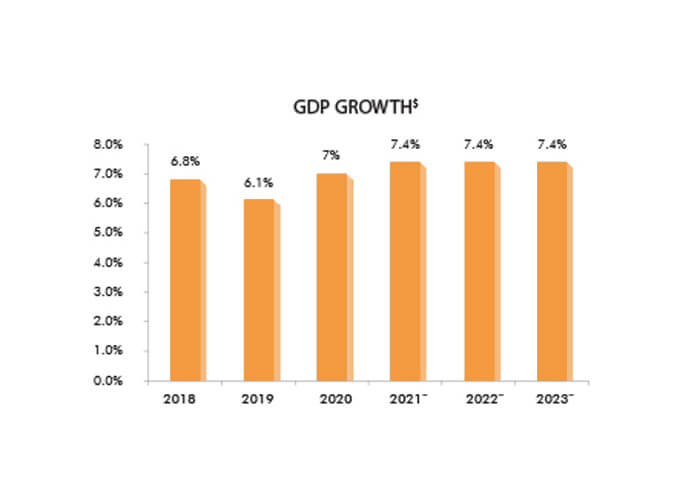

India has emerged as the world’s fastest growing major economy and is expected to be one of the top three economic powers of the world over the next 10-15 years.* Having decisively overtaken both France and the United Kingdom to become the world's fifth-largest economy in 2019, it is expected to overtake Germany to become fourth-largest in 2026 and Japan to become the third-largest by 2034.$

A consistently growing, stable and dependable economy, backed by its strong democracy and partnerships, arguably, makes India one of the world’s favourite investment destinations.

*Source: www.ibef.org

$Source: www.imf.org & www.theweek.in

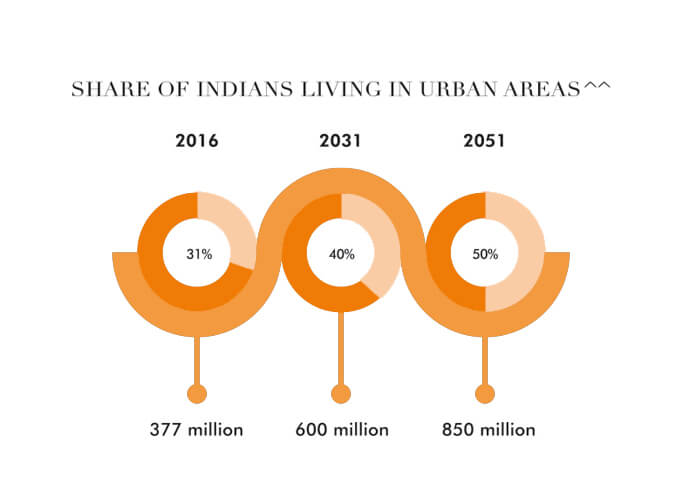

India is on the cusp of a massive urbanization which offers significant opportunities for real estate in Indian cities to deal with the rising demand for commercial and residential spaces.

According to industry reports, people living in urban areas will increase from 462 mn in 2018 to 600 mn in 2030. And a mammoth 5 mn homes per year need to be built from the current rate of 0.5 mn per year to accommodate this urban influx.^^ The real estate market is expected to contribute 13% of India’s GDP by 2025 and is pegged at $1 trillion by 2030.$$

Residential sales in the Indian market stay steady whilst the launches have grown by a healthy 23% YoY in 2019. The Indian office space market also has been growing for the better part of this decade. 2019 recorded a historic all-time high of 60.6 msf transactions in a calendar year, which is a 27% YoY growth over 2018.**

^^Source: www.bwsmartcities.businessworld.in

$$ Source: KPMG’s ‘Indian Real Estate and Construction: Consolidating for growth’ report 2018

**Source: Knight Frank India Research

Real estate investors make money from rental income which is a steady cash flow. Moreover, the value of real estate properties continues to appreciate over the years, even in the face of economic crisis.

Since real estate is a property, i.e. a tangible asset, it is possible for the property owners to improve the place by making modifications. The property can used and reused for various purposes with its value also fluctuating accordingly.

Real estate investments coincide with most people’s retirement plans. Once the loans on investment is paid off and cash flow becomes a steady process, it yields a greater return when the owner decides to retire.

Leveraging is one of the biggest pros of real estate investment. In such transactions, leverage occurs when investor capital needed to purchase the property is reduced because of the mortgage. After building equity on an investment property, you can leverage that in two ways – either by securing a second loan against the increased equity or by refinancing the original loan amount along with the increased equity.

There are many tax benefits of real estate investments. From depreciation to deferring payment, tax codes allow various deductions on payable tax by the investor.

Keeping these benefits in mind and more, it is a good and a smart choice to invest in real estate.